Click here to learn more.

In case you missed the virtual seminar this week on “Navigating Private Philanthropy During a Pandemic”, the recording can be found HERE and ask yourself, what will you do with your charitable dollars this year?

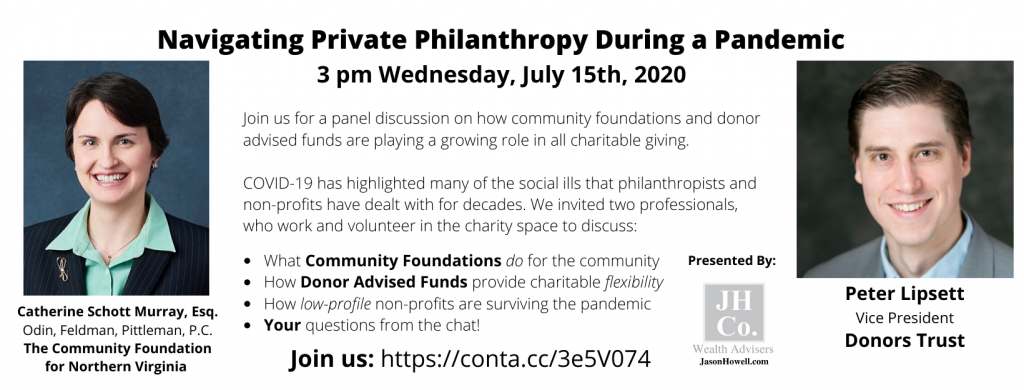

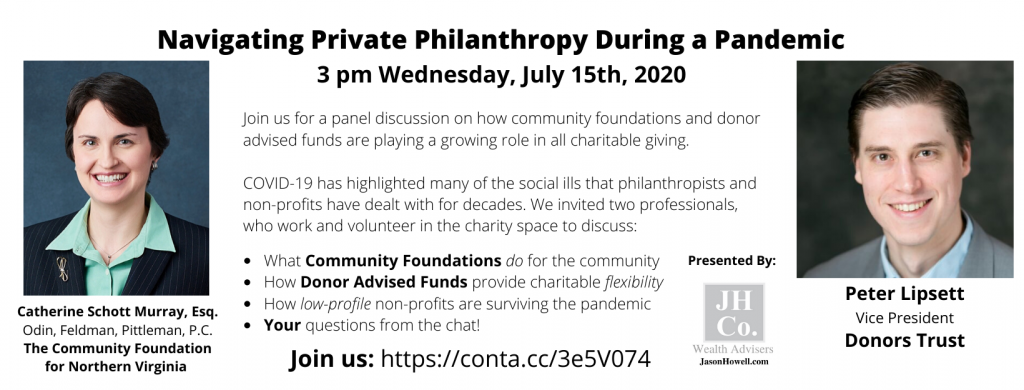

If you are looking to learn more about charitable giving and the options to engage in 2020, then please join me for a panel discussion on July 15, 2020 at 3:00 p.m. More information can be found here and below.

Currently there is a lot of focus on the Mega Millions that has a jackpot of $1.6 billion (and climbing) and many discussions are being had detailing what one would do if they won. Imagine the possibilities! Some of the considerations include making gifts and loans to friends and family members.

Currently there is a lot of focus on the Mega Millions that has a jackpot of $1.6 billion (and climbing) and many discussions are being had detailing what one would do if they won. Imagine the possibilities! Some of the considerations include making gifts and loans to friends and family members.

Although chances of winning are 1 in 302.5 million, if you do win and you are in a position to consider making gifts or loans to friends and family members, there are a few key points to remember to minimize any gift tax consequences. As highlighted in an earlier article, we each have the ability to gift during our lifetimes without incurring gift tax. The current exemption is $11.18 million per person above which a 40% flat tax is imposed. In order to utilize that exemption, a gift tax return is required.

Furthermore, each of us has the ability to gift up to $15,000 per person to an unlimited number of people each year. If you are married, a married couple can gift up to $30,000 per person each year. These annual gifts do not count against the lifetime exemption, and are therefore a separate method in which gifting can be made.

IRS regulations also permit you to pay the tuition expenses for a full-time or part-time student directly to the “qualifying educational organization” without having to claim an exemption from gift tax or incurring gift tax. Tuition expenses do not include books, supplies, dorm fees, board or other such expenses that are not direct tuition expenses.

In addition, you can pay for “qualifying medical expenses” that include expenses for diagnosis, cure, treatment, prevention as well as amounts paid for medical insurance. This exemption does not include any expenses that were reimbursed ultimately by medical insurance. Again, such expenses can be paid directly and you would not have to claim your lifetime exemption or incur gift tax.

And what about making loans to friends and family? Be sure that any loan you make is not deemed to be a gift. That is, the loan should impose interest at current fair market values. Applicable Federal Rates (AFR) for October range from 2.55% for short term loans (up to 3 years) to 2.99% for long term loans (over 9 years). Loans can be structured in myriad different ways.

Also, don’t forget about cash gifts to charity. The charitable deduction on your income tax returns was increased under last year’s tax reform act to 60% of your adjusted gross income for 2018, up from 50% of your AGI. The charities of your choice would also help facilitate a lifetime gift and/or planned gift depending your wishes.

So, while you are thinking about what you would do if you won a million dollars or more in the lottery, be sure to keep in mind a few gift or loan options that are available to you and good luck! #megamillions #winningthelottery #lottery #gifttax #estateplanning #taxplanning #planyourjourney

As the year draws to an end, many of you look to make your charitable donations or are advising individuals regarding their charitable donations. Of course, there are a variety of ways in which one can make such a charitable gift. The IRS recently published IR 2017-191, which is part of a series of articles providing taxpayers with relevant information so they can be ready for the next tax season. In this recent article, the IRS reminded taxpayers of certain aspects of charitable giving in an effort to help taxpayers avoid problems come tax time. I have summarized these helpful tips below.

As the year draws to an end, many of you look to make your charitable donations or are advising individuals regarding their charitable donations. Of course, there are a variety of ways in which one can make such a charitable gift. The IRS recently published IR 2017-191, which is part of a series of articles providing taxpayers with relevant information so they can be ready for the next tax season. In this recent article, the IRS reminded taxpayers of certain aspects of charitable giving in an effort to help taxpayers avoid problems come tax time. I have summarized these helpful tips below.

For starters, individuals can only receive a tax deduction if the charity to which they donate is an ‘eligible organization.’ The IRS has a website, Select Check, that is a searchable online database of ‘eligible organizations’ that can be used to verify the status of an organization.

Next, charitable donations can only be deducted if the taxpayer itemizes their deductions. For some this can be a hassle because that means maintaining accurate records and receipts. If the gift is larger than $250 to the charity, then a written acknowledgement is required. The IRS has provided Publication 526 on charitable contributions to help explain what records are necessary.

Additionally, if an individual is looking to donate tangible personal property like clothing or household items, those items have to be in ‘good used or better’ condition. Household goods include furniture, furnishings, electronics, appliances and linens. The taxpayer must obtain a detailed receipt in which the donated items are described for donations worth $250 or more. Items in which a deduction of more than $500 is claimed usually have to include a qualified appraisal.

Another factor to keep in mind is if the taxpayer receives any ‘benefit’ in the form of merchandise, meals, tickets or other items. The value of such ‘benefit’ will reduce the available deduction amount. For example, a contributor membership to the Kennedy Center is valued at $120, but only $80 of that amount is eligible to be deducted.

One alternative to keeping lots of records and receipts from every organization is the creation of a donor advised fund. An individual can make a single larger contribution to his or her donor advised fund and from that donor advised fund make specific charitable donations. There are a variety of terms and conditions to follow, but the single contribution means that is what is reported on one’s tax returns. Here is just one person’s rationale behind the creation of a donor advised fund that also allowed her to get more involved with her community.

Ultimately, any gift is welcomed by the charity and you should feel free to reach out to the charity or your professional advisor if you have questions or need assistance in making year-end charitable donations. #GivingTuesday @CFNOVA @bgnthebgn #donoradvisedfunds #taxplanning #charitablegiving

Happy New Year! Very often the New Year brings all sorts of ‘changes’ for individuals, particularly after having spent any time with family members and friends over the holiday season. Here is a quick list of five resolutions to consider for your estate plan.

Happy New Year! Very often the New Year brings all sorts of ‘changes’ for individuals, particularly after having spent any time with family members and friends over the holiday season. Here is a quick list of five resolutions to consider for your estate plan.

True, there are a lot of questions and not a lot of answers here, but that is the planning process. One has to begin with the questions to reach the answers. Working with a professional advisor can both provide you with the guidance needed to navigate these questions and ensure that you complete the process. #planyourjourney #lifeplanning #legacyplanning #estateplanning @bgnthebgn

Welcome to the New Year! As with any new year, there are usually changes to a variety of important numbers for estate planning and elder law purposes. This year the applicable exclusion amount from Federal estate tax is set at $5.49 million per person. The lifetime exclusion from gift tax is also $5.49 million per person and the exemption from generation skipping transfer tax is $5.49 million. The annual exclusion from gift tax remains at $14,000. The annual exclusion for gifts to non-U.S. citizen spouses increased to $149,000.

Welcome to the New Year! As with any new year, there are usually changes to a variety of important numbers for estate planning and elder law purposes. This year the applicable exclusion amount from Federal estate tax is set at $5.49 million per person. The lifetime exclusion from gift tax is also $5.49 million per person and the exemption from generation skipping transfer tax is $5.49 million. The annual exclusion from gift tax remains at $14,000. The annual exclusion for gifts to non-U.S. citizen spouses increased to $149,000.

For local jurisdictions that have estate tax, the District of Columbia increased its estate tax exemption from $1,000,000 to $2,000,000. Maryland’s exemption from estate tax has increased to $3,000,000. Virginia continues to have no state level estate or inheritance tax.

In the elder law field, the Medicaid spousal impoverishment numbers were released increasing the minimum community spouse resource allowance (CSRA) to $24,180 and the maximum CSRA to $120,900. The maximum monthly maintenance needs allowance is now $3,022.50 while the minimum remains at $2,002.50. The minimum home equity limit is now $560,000 and the maximum is $840,000, but be aware that local jurisdictions may apply these limits differently.

If you have questions regarding the new limits and how they may impact your estate planning, your should consult your professional advisor. #estateplanning #taxplanning #elderlaw @bgnthebgn

As the year draws to an end, many of you look to make your charitable donations or are advising individuals regarding their charitable donations. Of course, there are a variety of ways in which one can make such a charitable gift. The IRS recently published IR-2016-154, which is part of a series of articles providing taxpayers with relevant information so they can be ready for the next tax season. In this recent article, the IRS reminded taxpayers of certain aspects of charitable giving in an effort to help taxpayers avoid problems come tax time. I have summarized these helpful tips below.

As the year draws to an end, many of you look to make your charitable donations or are advising individuals regarding their charitable donations. Of course, there are a variety of ways in which one can make such a charitable gift. The IRS recently published IR-2016-154, which is part of a series of articles providing taxpayers with relevant information so they can be ready for the next tax season. In this recent article, the IRS reminded taxpayers of certain aspects of charitable giving in an effort to help taxpayers avoid problems come tax time. I have summarized these helpful tips below.

For starters, individuals can only receive a tax deduction if the charity to which they donate is an ‘eligible organization.’ The IRS has a website, Select Check, that is a searchable online database of ‘eligible organizations’ that can be used to verify the status of an organization.

Next, charitable donations can only be deducted if the taxpayer itemizes their deductions. For some this can be a hassle because that means maintaining accurate records and receipts. If the gift is larger than $250 to the charity, then a written acknowledgement is required. The IRS has provided Publication 56 on charitable contributions to help explain what records are necessary.

Additionally, if an individual is looking to donate tangible personal property like clothing or household items, those items have to be in ‘good used or better’ condition. Household goods include furniture, furnishings, electronics, appliances and linens. The taxpayer must obtain a detailed receipt in which the donated items are described for donations worth $250 or more. Items in which a deduction of more than $500 is claimed usually have to include a qualified appraisal.

Another factor to keep in mind is if the taxpayer receives any ‘benefit’ in the form of merchandise, meals, tickets or other items. The value of such ‘benefit’ will reduce the available deduction amount. For example, a contributor membership to the Kennedy Center is valued at $120, but only $80 of that amount is eligible to be deducted.

One alternative to keeping lots of records and receipts from every organization is the creation of a donor advised fund. An individual can make a single larger contribution to his or her donor advised fund and from that donor advised fund specific charitable donations can be made. There are a variety of terms and conditions to follow, but the single contribution means that is what is reported on one’s tax returns. Here is just one person’s rationale behind the creation of a donor advised fund that also allowed her to get more involved with her community.

Ultimately, any gift is welcomed by the charity and you should feel free to reach out to the charity or your professional advisor if you have questions or need assistance in making year-end charitable donations. @CFNOVA @bgnthebgn #donoradvisedfunds #taxplanning #charitablegiving

As another year begins many individuals make resolutions. Very often one of those resolutions is to have an estate plan prepared or update an outdated estate plan. A couple of considerations in preparing an estate plan is whether you are charitably inclined and would you like to do more for your community? A donor advised fund is one way to set aside funds for charitable purposes that can be capitalized upon during your lifetime and within your estate plan. Moreover, a donor advised fund can continue after you are gone. Here is just one person’s rationale behind the creation of a donor advised fund that also allowed her to get more involved with her community. @CFNOVA #donoradvisedfunds #taxplanning #charitablegiving