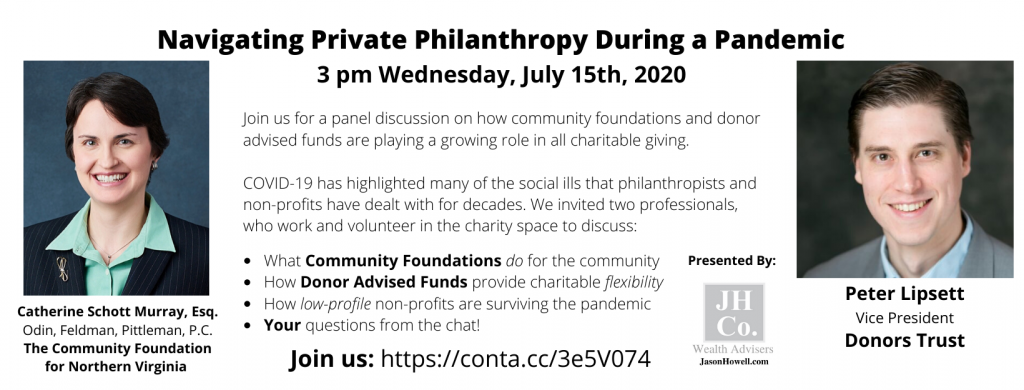

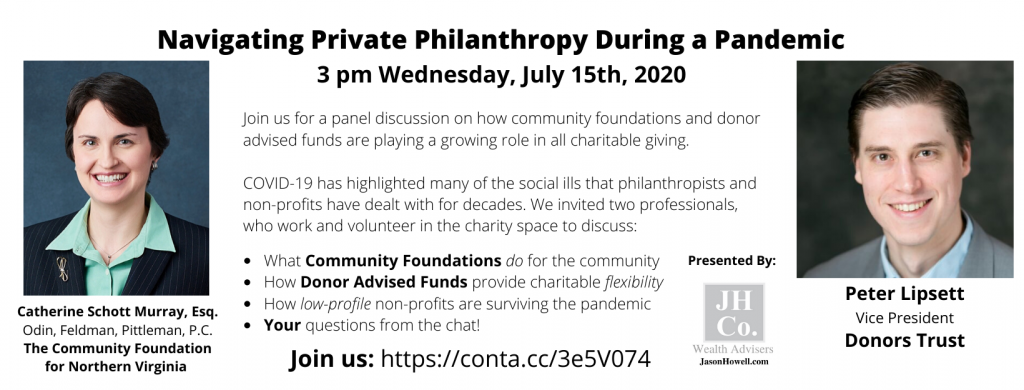

If you are looking to learn more about charitable giving and the options to engage in 2020, then please join me for a panel discussion on July 15, 2020 at 3:00 p.m. More information can be found here and below.

If you are looking to learn more about charitable giving and the options to engage in 2020, then please join me for a panel discussion on July 15, 2020 at 3:00 p.m. More information can be found here and below.

Here is a roundup of the June news from the Odin, Feldman & Pittlemen, P.C. COVID-19 Resource Center and about new Virginia statutes.

On June 3, 2020, the Paycheck Protection Program Flexibility Act of 2020 (PPP Flexibility Act) was unanimously approved by the Senate, after overwhelming approval by the House last week. Under the PPP Flexibility Act, which is expected to be signed into law by the President, the CARES Act was amended to provide additional flexibility to borrowers. The highest profile change is to the definition of “covered period,” which now shifts from eight weeks from loan origination to the earlier of 24 weeks or Dec. 31, 2020.

Learn more about the PPP Flexibility Act from Shareholder Michelle DiCintio by CLICKING HERE.

In an attempt to make chapter 11 more streamlined and less expensive for debtors, Congress amended the bankruptcy code to add a brand new reorganization chapter: Subchapter V. Subchapter V is available exclusively to small-business debtors and provides a new option that is intended to be quicker and cheaper; it also offers less oversight and fewer reporting requirements than a traditional chapter 11 case. Congress originally made the new Subchapter V option available to all businesses with $2.7 million or less in aggregate secured and unsecured non-contingent and liquidated debt. That amount was increased to $7.5 million for the rest of 2020 under the CARES Act.

Learn more from OFP Attorney Brad Jones: CLICK HERE.

Earlier this month the Small Business Administration (SBA) and Department of Treasury streamlined the path to applying for loan forgiveness under the Paycheck Protection Program (PPP), the lifeline extended to small businesses suffering financial pressures resulting from the COVID-19 pandemic. A revised loan forgiveness application and a new EZ version of the form are designed to slash the layers of paperwork, documentation and calculations required to request loan forgiveness. New instructions for Borrowers were also issued for both the Revised Form and the EZ Form.

Learn more from OFP Shareholder Michelle DiCintio.

Spring brought significant changes to Virginia’s employment law landscape. Virginia Governor Ralph Northam recently signed a series of new employee-centric laws, including the ones intended to fight against worker misclassification.

Learn more from OFP Shareholder Sara Sakagami: CLICK HERE.

The latest from OFP attorneys regarding the impact of COVID-19 on commercial lease agreements.

Commercial Leases and COVID-19:

Force Majeure, Frustration of Purpose, and Impossibility under the Laws of Virginia, Maryland, and the District of Columbia

As landlords and tenants in the DC Metro region navigate the COVID-19 climate and an unprecedented dip in the economy, provisions within commercial leases related to excusing nonperformance are being tested, and in some cases, for the first time. Force majeure clauses are front and center in the debate over excuses for nonperformance, opportunities for termination, and the allocation of liability. However, the common law doctrines of frustration of purpose and impossibility may also be applicable. This set of articles explores the defenses that may be available to commercial tenants in Virginia, Maryland, and the District of Columbia during the coronavirus pandemic, keeping in mind that in these unprecedented times, case law on the impact of the crisis is developing.

To learn more about Virginia, CLICK HERE.

To learn more about Maryland, CLICK HERE.

To learn more about the District of Columbia, CLICK HERE.

Here are the latest legal articles relating to the impact of COVID-19 on individuals and businesses.

As has been much discussed, loan forgiveness is a key feature of the CARES Act’s Paycheck Protection Program (PPP) administered by the Small Business Administration (SBA), but there has been little guidance regarding the process and criteria for seeking forgiveness. Late Friday, May 15, 2020, the SBA and Department of Treasury released the PPP loan forgiveness application and related instructions, providing some clarity. Additionally, the Treasury Department indicated in an associated press release that the SBA will issue regulations and guidance to further assist borrowers in the completion of their applications for forgiveness, and provide lenders with guidance on their responsibilities. Learn more from OFP Shareholder Michelle DiCintio.

On May 13, 2020, the Small Business Administration (SBA) again updated its guidance regarding the safe harbor provision for loans disbursed under the Paycheck Protection Program (PPP), the lifeline extended to small businesses under the financial relief package known as the CARES Act. Learn more from OFP Shareholder Michelle DiCintio.

Although Northern Virginia, Maryland and DC are not fully ready to begin easing COVID-19 restrictions, business leaders are preparing now. What can landlords and tenants do today to survive a challenging second quarter, prepare for reopening, and emerge strong for the rest of 2020?

Practical Advice for Landlords

In Part I of OFP’s COVID-19 Commercial Leasing Playbook, we focus on steps that landlords should be considering as they work together with all stakeholders to document a realistic short-term plan and remain flexible in the coming months.

Click here to learn more from OFP Shareholders Jennifer Banks and Leslye Fenton.

Practical Advice for Tenants

In Part II of OFP’s COVID-19 Commercial Leasing Playbook, we focus on steps that tenants should be considering as they work together with all stakeholders to document a realistic short-term plan and remain flexible in the coming months.

Click here to learn more from OFP Shareholders Jennifer Banks and Leslye Fenton.

Practical Advice for DC Retail Tenants

In Part III of OFP’s COVID-19 Commercial Leasing Playbook, we focus on steps that retails tenants in Washington, DC, should be considering as they work together with all stakeholders to document a realistic short-term plan and remain flexible in the coming months.

Click here to learn more from OFP Shareholders Jennifer Banks and Leslye Fenton.

On July 1, 2020, the Virginia Values Act (VVA) will become effective as law and introduce new legal protections designed to make the Commonwealth a more accepting workplace for all members of society. In doing so, the VVA is expected to produce a sweeping overhaul of employment discrimination litigation in Virginia by prohibiting employment discrimination on the basis of sexual orientation, gender identity, and veteran status. These changes, unprecedented thus far in southern states, will significantly impact employers while providing additional protections and remedies to employees.

Learn more from OFP Attorney Cameron Green.

Below please find the latest articles from Odin, Feldman & Pittleman, P.C. relating to recent legal updates impacting individuals and businesses as a result of COVID-19.

US DEPARTMENT OF LABOR – PAID SICK LEAVE PROVISIONS

The US Department of Labor (“DOL”) issued a notice that covered employers are required to share regarding the recently passed paid sick leave provisions. At present, the DOL is soliciting questions from employers and employees as the agency prepares to draft enabling regulations to address how to implement these paid-leave provisions. As shown by this solicitation for comments and questions, there are many open questions about how an employer is to respond to requests for coverage. Learn more here.

SBA ANNOUNCES DISASTER ASSISTANCE FOR SMALL BUSINESSES

The Small Business Administration has relaxed requirements for small businesses whose operations have been disrupted by COVID-19. SBA Disaster Relief loans may be used to “…pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact. The interest rate is 3.75% for small businesses. The interest rate for non-profits is 2.75%.” Read more here.

COVID-19 is creating unprecedented business disruptions around the globe, and it is important to take this situation seriously. Acting with urgency is crucial, but having a plan of attack will mitigate confusion down the road. Click here to learn more.

NEW OMB GUIDANCE ENCOURAGING FOR GOVERNMENT CONTRACTORS

In an attempt to mitigate the unfolding COVID-19 public health emergency, state and local governments have started issuing “lockdown” or “stay-at-home” orders. Generally, the state lockdown orders have directed that all businesses utilize telecommuting or work-from-home procedures to the maximum extent practicable. Where telework is impractical, some states are only permitting essential businesses to remain open. Companies with operations in these jurisdictions must understand the scope of applicable restrictions and whether their operations are essential and should continue during the lockdown. Learn more from attorney Michelle DiCintio.

IS YOUR WORK OR BUSINESS CONSIDERED “ESSENTIAL”?

OFP Shareholder Shiva Hamidinia provides a run-down to help businesses determine whether they are deemed essential as the country works to maintain social distancing protocols to help stem the spread of COVID-19. Click here to learn more.

COVID-19 – CREDIT FACILITIES AND ECONOMIC UNCERTAINTY

As COVID-19 continues to stir economic uncertainty, businesses are concerned about possible defaults under their credit facilities and some businesses may want to consider how they are using credit vehicles to support ongoing operations. Click here to learn more.

Businesses and individuals now will have until July 15th to file and pay their Federal income taxes. This means that you have an additional three months to plan and prepare your returns without having incurring penalties on up to $1 million in tax owed. Businesses will have the same period to pay amounts due on up to $10 million in tax owed. Learn more from attorney Catherine Schott Murray.

On March 18, 2020, the Families First Coronavirus Response Act was signed into law and will become effective not later than 15 days later, April 2, 2020. There are some differences between what was ultimately passed and what was summarized in our early article from March 16, 2020. Learn more from attorney Marina Blickley.

Construction and many other contractors who cannot telework may be receiving stop-work orders or facing other unique challenges on their government contracts in the face of COVID-19. Impacts may be exacerbated for personnel working in the field who may not be receiving guidance from the government due to unavailability of their Contracting Officers (CO) or Contracting Officer Representatives (COR). Learn more from attorney Shiva Hamidinia.

As the coronavirus shifts the way the world works, businesses should take this break in normal operating procedure to re-evaluate their finances. Learn more from attorney Brad Jones.

Out of an abundance of caution and with the utmost respect for our seniors and their caregivers, we have postponed the launch of our upcoming series, Real Talk: The Essentials of Aging with Confidence, until further notice.

We hope to proceed with our April session if it is prudent to do so. Be sure to watch for more information in the coming weeks.

This month we begin the first of a 3-part series in which we tackle topics involving The Essentials of Aging with Confidence. Details below including where to register. We look forward to seeing you there!

March 18th – Part 1: Getting Your Estate in Order

April 22nd – Part 2: Aging in Place or Assisted Living? Which option works for your lifestyle?

May 13th – Part 3: The Essential Guide to Aging and Caregiving.

@bgnthebgn @ofplaw @sandyspringbank #shepherdscenter #agingwithconfidence

The end of the year is always a busy time of the year particularly in estate and tax planning. 2019 was no exception as on December 20th, the Setting Every Community Up for Retirement Enhancement Act (“the SECURE Act”) was signed into law. The SECURE Act took effect on January 1, 2020 and makes significant changes to qualified individual retirement account (“IRA”) planning, including the elimination of the stretch IRA for inherited IRAs, among other changes. Treasury Regulations have not yet been issued, so some of the details in the SECURE Act are still unknown and the gaps are not yet filled.

Before summarizing the elimination of the stretch IRA provisions, a few of the other key changes under the SECURE Act included the following:

As mentioned, the most significant change under the SECURE Act is the elimination of the ability to stretch an inherited IRA (or 401(k) or 403(b)) with certain exceptions. The default rule now is that inherited IRAs must be fully distributed by the end of the 10th year following the death of the account owner. For example, if an account owner dies in 2020, leaving his or her IRA to a named beneficiary (who is not one of the defined exceptions), all monies from that IRA must be distributed by the end of 2030. The prior rule allowed beneficiaries to use their life expectancy to determine any required payout.

There are a few exceptions to this new default rule. Individuals who are permitted to stretch the inherited retirement account over their lifetime include:

The result of the new default rule for those who do not fall into an exempt category is that there will be less tax-deferred growth in the retirement account and an increase in income taxes because the rate of withdrawal has been accelerated.

There are some strategies available, which will be explained in more detail in later articles, that could help mitigate the increased tax liability. Those strategies include:

These strategies are heavily dependent on the specific circumstances faced by each IRA account holder and should be reviewed carefully.

Lastly, for many who have had their estate planning prepared, that plan may be structured around a revocable living trust with the revocable living trust being designated as the beneficiary of the IRA. As a result, those beneficiary designations and the terms of the trust need to be revisited as unintended income tax consequences may result because of the new 10 year default payout rule.

As for next steps, if you haven’t reviewed your beneficiary designations and your estate plan recently, you should consult with your team of professional advisors who can help explore the options available to you based on your situation. #estateplanning #SECUREAct #taxplanning @bgnthebgn @OFPLAW

Here is a little humor to keep you going and is a gentle reminder of a situation you want to avoid. Plan your journey! #estateplanningmatters #planyourjourney @bgnthebgn