Wishing You a Wonderful Holiday Season!

During this time of year as families gather for the holidays, it is important to gain clarity as to the wishes of your parents in order to protect their legacy. Check out this podcast in which members of Monument Wealth Management and I discuss how best to approach the conversation of incapacity and dying. #estateplanning #incapacityplanning

In May, I sat down with Jason Howell to discuss the process of estate planning and why it is important that families “begin the begin”. Check out the podcast/video recording of our time together. #estateplanning #incapacityplanning #beginthebegin

I recently spent time with two friends, who happen to be financial advisors, where we discussed the proposed tax reform legislation and what it means for estate planning now and in the future. A link to the podcast is here. Enjoy listening! #estateplanning #legacyplanning #taxplanning #taxreform

Wishing you and yours a peaceful, joyous and healthy New Year!

THANK YOU FOR YOUR SUPPORT THIS PAST YEAR. WISHING YOU AND YOURS A WONDERFUL AND PEACEFUL THANKSGIVING!

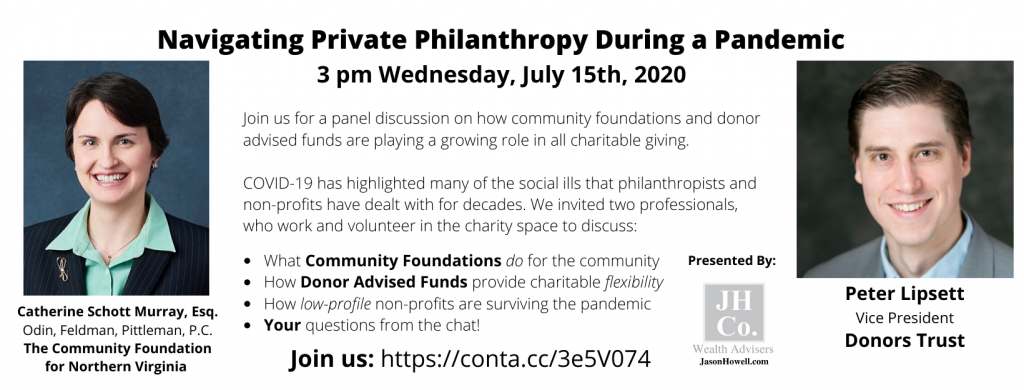

In case you missed the virtual seminar this week on “Navigating Private Philanthropy During a Pandemic”, the recording can be found HERE and ask yourself, what will you do with your charitable dollars this year?