Click image for a message from the Firm!

During this time of year as families gather for the holidays, it is important to gain clarity as to the wishes of your parents in order to protect their legacy. Check out this podcast in which members of Monument Wealth Management and I discuss how best to approach the conversation of incapacity and dying. #estateplanning #incapacityplanning

In May, I sat down with Jason Howell to discuss the process of estate planning and why it is important that families “begin the begin”. Check out the podcast/video recording of our time together. #estateplanning #incapacityplanning #beginthebegin

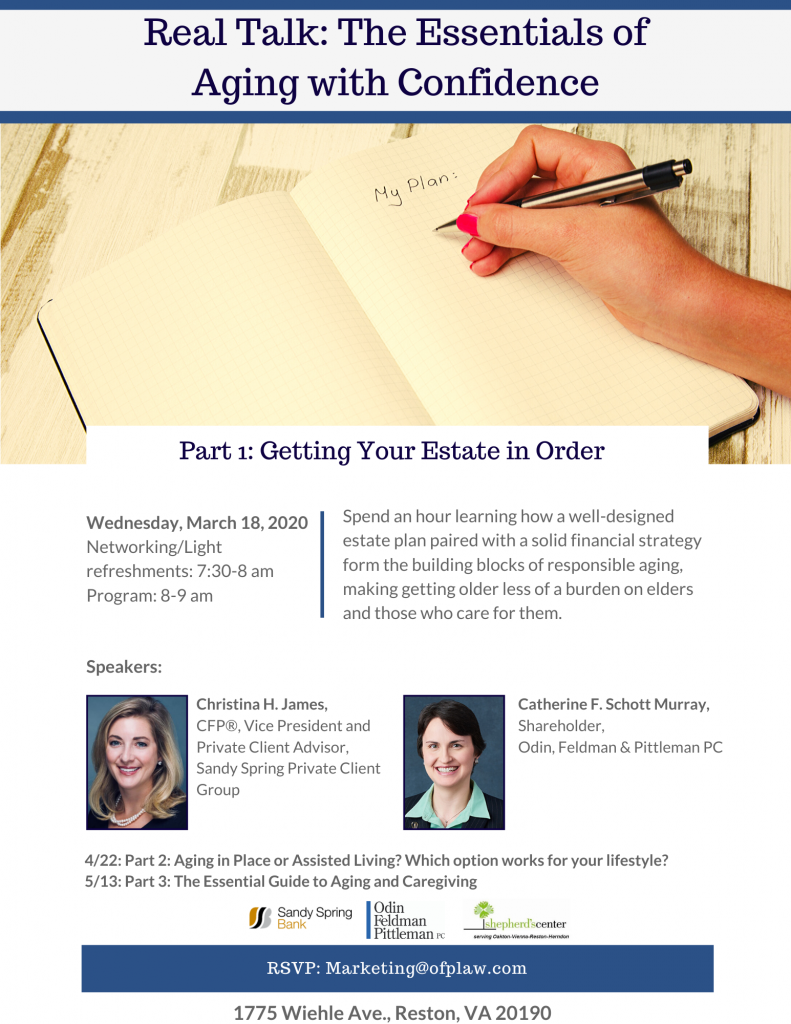

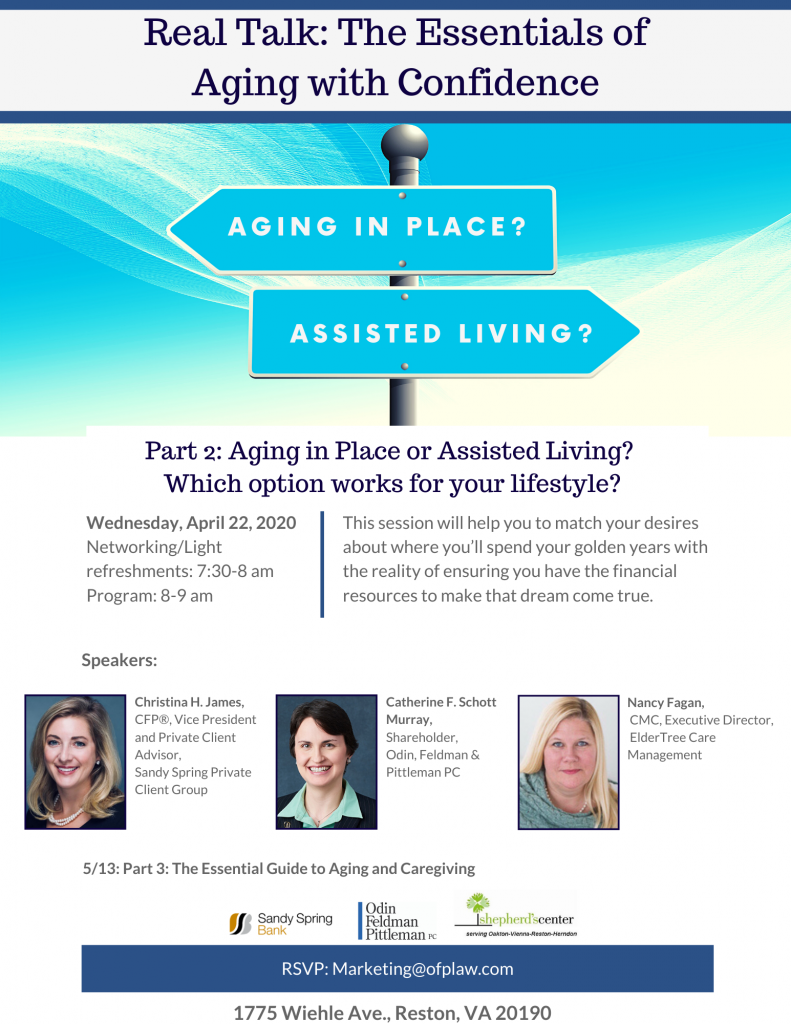

Out of an abundance of caution and with the utmost respect for our seniors and their caregivers, we have postponed the launch of our upcoming series, Real Talk: The Essentials of Aging with Confidence, until further notice.

We hope to proceed with our April session if it is prudent to do so. Be sure to watch for more information in the coming weeks.

This month we begin the first of a 3-part series in which we tackle topics involving The Essentials of Aging with Confidence. Details below including where to register. We look forward to seeing you there!

March 18th – Part 1: Getting Your Estate in Order

April 22nd – Part 2: Aging in Place or Assisted Living? Which option works for your lifestyle?

May 13th – Part 3: The Essential Guide to Aging and Caregiving.

@bgnthebgn @ofplaw @sandyspringbank #shepherdscenter #agingwithconfidence

Check out the brief interview I did regarding my new role as President of the Virginia Academy of Elder Law Attorneys.

Check out the brief interview I did regarding my new role as President of the Virginia Academy of Elder Law Attorneys.

The Virginia Academy of Elder Law Attorneys, or VAELA, is a non-profit professional organization. Its mission is to educate and empower legal representation of elderly and/or disabled clients and their families. OFP Shareholder Catherine F. Schott Murray currently serves as VAELA’s President.

How does VAELA help protect/advocate the interests of seniors or the disabled?

Catherine F. Schott Murray: VAELA Is leading the way in special needs and elder law in Virginia by educating, inspiring and empowering legal representation of elderly and disabled clients and their families, and by advocating their issues before courts and legislatures. In representing a diverse set of individuals and families with unique issues by providing practical and common-sense advice, VAELA members help their clients to protect family members with disabilities and to age with dignity.

Welcome to the New Year! As with any new year, there are usually changes to a variety of important numbers for estate planning and elder law purposes. This year the applicable exclusion amount from Federal estate tax is set at $11.18 million per person thanks to tax reform. The lifetime exclusion from gift tax is also $11.18 million per person and the exemption from generation skipping transfer tax is $11.18 million. The annual exclusion from gift tax will be at least $14,000.

Welcome to the New Year! As with any new year, there are usually changes to a variety of important numbers for estate planning and elder law purposes. This year the applicable exclusion amount from Federal estate tax is set at $11.18 million per person thanks to tax reform. The lifetime exclusion from gift tax is also $11.18 million per person and the exemption from generation skipping transfer tax is $11.18 million. The annual exclusion from gift tax will be at least $14,000.

For local jurisdictions that have estate tax, the District of Columbia increased its estate tax exemption from $1,000,000 to $2,000,000 last year and this year has increased the threshold further to match the Federal exemption. Maryland’s exemption from estate tax has increased to $4,000,000. Virginia continues to have no state level estate or inheritance tax.

In the elder law field, the Medicaid spousal impoverishment numbers were released increasing the minimum community spouse resource allowance (CSRA) to $24,720 and the maximum CSRA to $123,600. The maximum monthly maintenance needs allowance is now $3,090.00 while the minimum remains at $2,030.00. The minimum home equity limit is now $572,000 and the maximum is $858,000, but be aware that local jurisdictions may apply these limits differently.

If you have questions regarding the new limits and how they may impact your estate planning, your should consult your professional advisor. #estateplanning #taxplanning #elderlaw #taxreform #HappyNewYear @bgnthebgn

The IRS recently announced the estate and gift exemption levels for 2018 and they continue to increase as per legislation passed in January 2013. The applicable exclusion amount from Federal estate tax will increase to $5.6 million per person allowing a married couple to shelter $11.2 million from Federal estate tax, the rate for which is currently set at 40%. The lifetime exemption from gift tax remains coupled with the exemption from Federal estate tax, and therefore, this exemption will also increase to $5.6 million per person. The annual gift exclusion amount will also increase for the first time since 2013 and will be $15,000 per person. Virginia continues to not impose a state level estate tax. Maryland’s exemption from estate tax will increase to $4 million while the District of Columbia’s now $2 million exemption will rise to meet the Federal exemption beginning in 2018 so long as there is a revenue surplus.

The IRS recently announced the estate and gift exemption levels for 2018 and they continue to increase as per legislation passed in January 2013. The applicable exclusion amount from Federal estate tax will increase to $5.6 million per person allowing a married couple to shelter $11.2 million from Federal estate tax, the rate for which is currently set at 40%. The lifetime exemption from gift tax remains coupled with the exemption from Federal estate tax, and therefore, this exemption will also increase to $5.6 million per person. The annual gift exclusion amount will also increase for the first time since 2013 and will be $15,000 per person. Virginia continues to not impose a state level estate tax. Maryland’s exemption from estate tax will increase to $4 million while the District of Columbia’s now $2 million exemption will rise to meet the Federal exemption beginning in 2018 so long as there is a revenue surplus.

Additionally, in the last article, the fate of the proposed valuation discounting regulations was still up in the air. However, Treasury issued a second report to the President in which those regulations were withdrawn. Therefore, the availability of valuation discounting on certain transfers of interests held in closely held or family owned businesses remains available and is currently no longer under threat.

For seniors and those with disabilities, a cost-of-living adjustment (COLA) for Social Security and Social Security Income (“SSI”) will increase monthly benefits by 2.0%. In addition, the cap on the amount of earnings subject to payroll tax will increase to $128,700. Finally, the tax brackets, standard deductions, Pease and PEP limitations, kiddie tax and other credit and deduction levels for 2018 were announced. Many are watching the tax reform debate to see if any of these numbers will change, so stay tuned… #taxreform #estateplanning #estatetax #taxplanning #taxtime #COLA2018 @bgnthebgn

Last year, the Centers for Medicare and Medicaid Services (“CMS”) issued a rule banning the use of binding pre-dispute arbitration agreements by nursing homes that accept Medicare and Medicaid patients. The result of the new rule would have been that families who have an issue with a nursing home regarding care, abuse, and the like, would have been able to sue in court to have their case heard versus having to go through a binding arbitration process. However, the American Health Care Association along with four long-term care providers filed suit against the Health and Human Services Secretary and CMS arguing that the agencies overstepped their authority in issuing the rule. Injunctive relief was granted preventing the rule from going into effect.

Last year, the Centers for Medicare and Medicaid Services (“CMS”) issued a rule banning the use of binding pre-dispute arbitration agreements by nursing homes that accept Medicare and Medicaid patients. The result of the new rule would have been that families who have an issue with a nursing home regarding care, abuse, and the like, would have been able to sue in court to have their case heard versus having to go through a binding arbitration process. However, the American Health Care Association along with four long-term care providers filed suit against the Health and Human Services Secretary and CMS arguing that the agencies overstepped their authority in issuing the rule. Injunctive relief was granted preventing the rule from going into effect.

In May of this year, the U.S. Supreme Court in Kindred Nursing Centers L.P. vs. Clark, overturned a ruling by the Kentucky Supreme Court in which the Kentucky Supreme Court stated that durable powers of attorney must explicitly permit an agent to enter into an arbitration agreement or otherwise risk violating the Kentucky Constitution where access to the courts and a trial by jury is ‘sacred’ and inviolate’. Instead the U.S. Supreme Court held that Kentucky’s ruling violated the Federal Arbitration Act by treating arbitration agreements differently.

As a result, earlier this month CMS issued proposed revisions to its arbitration agreement requirements for nursing homes and long-term care facilities. CMS is no longer proposing a ban on arbitration agreements in admissions agreements, but it is requiring greater transparency as to the meaning and understanding of such provisions in admissions agreements. Thus, it appears at this juncture that CMS is trying to find some middle ground between a complete ban on arbitration agreements and the decision in the Kindred case, but only time will tell if that middle ground has been found between the rights of the families of patients and the long-term care facilities. #elderlaw #elderabuse #nursinghome #arbitration #CMS #SCOTUS @bgnthebgn

At a recent Moms at Work event hosted by Claire M. S. Meade, discussion was held about those who are part of the “sandwich generation”, that is those who have young children, but also older parents. In particular, the conversation centered on questions to ask retired or retiring parents to help facilitate a discussion about aging. Many earlier articles have addressed estate planning, including planning for incapacity and planning for death. But this discussion highlighted three basic questions that MIT AgeLab identified as key when considering what it means to be retired. The simple questions are: (1) Who will change my light bulbs? (2) How will I get an ice cream cone? (3) With whom will I have lunch? These seem like very basic questions, but when you start to think beyond the initial concept to the considerations that each question raises, you realize that there are a lot of details to address in each question as it relates to retirement and aging. Check out the MIT AgeLab article for more details and think about beginning the conversation with your retired or retiring family member to avoid finding yourself in a situation where it is too late to plan. @bgnthebgn @josephcoughlin #incapacityplanning #estateplanning #aginginplace #retirementplanning #sandwichgeneration

At a recent Moms at Work event hosted by Claire M. S. Meade, discussion was held about those who are part of the “sandwich generation”, that is those who have young children, but also older parents. In particular, the conversation centered on questions to ask retired or retiring parents to help facilitate a discussion about aging. Many earlier articles have addressed estate planning, including planning for incapacity and planning for death. But this discussion highlighted three basic questions that MIT AgeLab identified as key when considering what it means to be retired. The simple questions are: (1) Who will change my light bulbs? (2) How will I get an ice cream cone? (3) With whom will I have lunch? These seem like very basic questions, but when you start to think beyond the initial concept to the considerations that each question raises, you realize that there are a lot of details to address in each question as it relates to retirement and aging. Check out the MIT AgeLab article for more details and think about beginning the conversation with your retired or retiring family member to avoid finding yourself in a situation where it is too late to plan. @bgnthebgn @josephcoughlin #incapacityplanning #estateplanning #aginginplace #retirementplanning #sandwichgeneration

Earlier articles have talked about how you can control your final moments and also how you want to be remembered. This year National Healthcare Decisions Day is a week long event beginning April 16 and ending on April 22. Such recognition provides a reminder that having an advance medical directive and a living will in which you express your wishes regarding medical care, if you cannot decide, and whether you want life-prolonging procedures, are crucial components in every estate plan. Several states and the District of Columbia have addressed end of life decision-making through death with dignity statutes. But, regardless of your position on death with dignity statutes, end of life decision-making and advance healthcare planning is a necessary conversation to have and to share with your loved ones and National Healthcare Decisions Day (or for this year week) helps remind us of the need to begin the dialog on the subject. @deathwdignity @NHDD #livingwill #estateplanning #endoflife #advancedirective #NHDD

Earlier articles have talked about how you can control your final moments and also how you want to be remembered. This year National Healthcare Decisions Day is a week long event beginning April 16 and ending on April 22. Such recognition provides a reminder that having an advance medical directive and a living will in which you express your wishes regarding medical care, if you cannot decide, and whether you want life-prolonging procedures, are crucial components in every estate plan. Several states and the District of Columbia have addressed end of life decision-making through death with dignity statutes. But, regardless of your position on death with dignity statutes, end of life decision-making and advance healthcare planning is a necessary conversation to have and to share with your loved ones and National Healthcare Decisions Day (or for this year week) helps remind us of the need to begin the dialog on the subject. @deathwdignity @NHDD #livingwill #estateplanning #endoflife #advancedirective #NHDD